Rules of Intestacy

When someone in England and Wales dies without a valid Will, there are laws which apply to their estate. These laws are known as the rules of intestacy.

The rules of intestacy set out the distribution of assets to the beneficiaries and who can administer the estate.

Who can inherit if there is no Will?

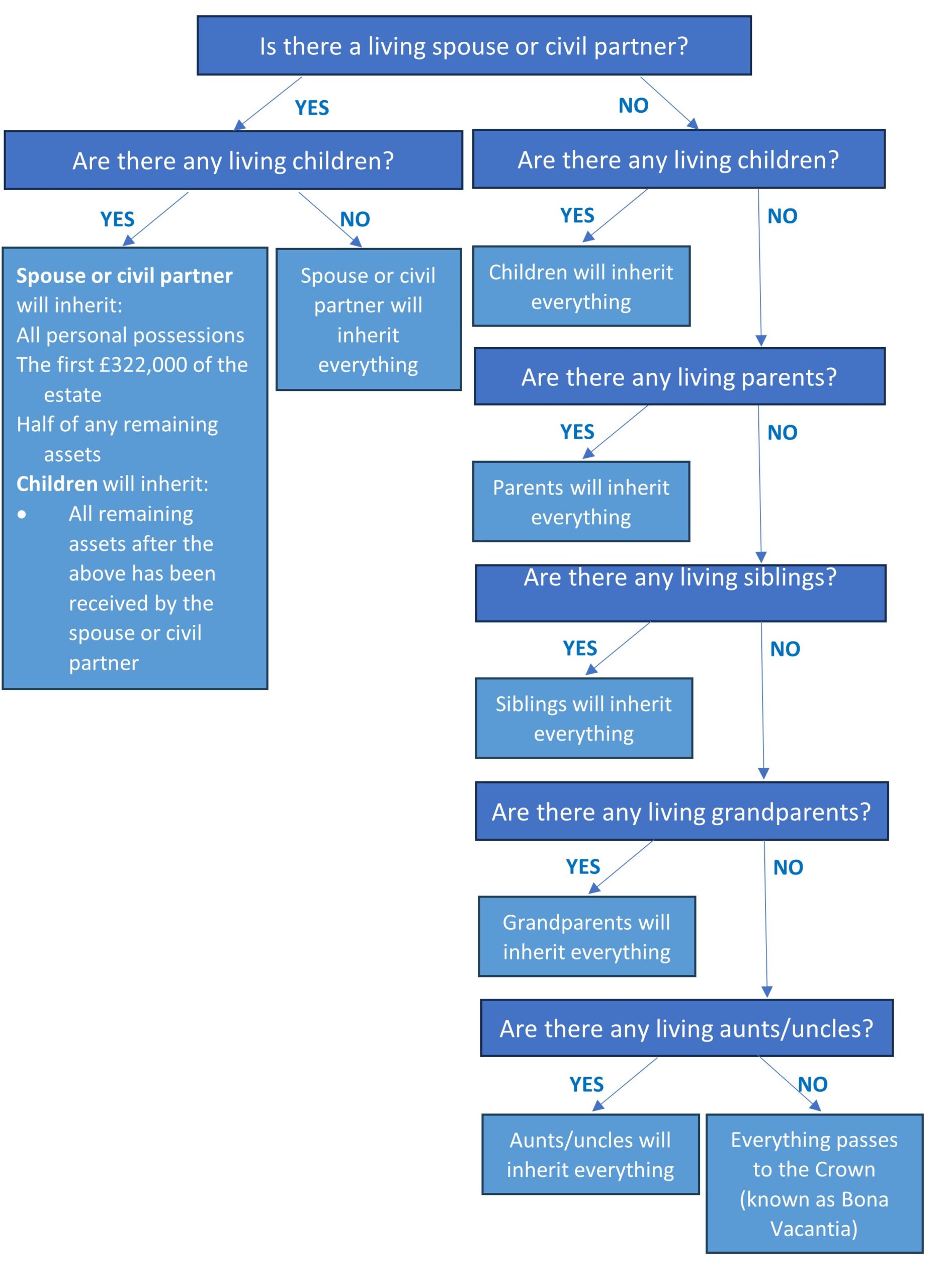

Follow the flowchart below to find out who will inherit the estate if there is no Will.

- If a child, sibling, or aunt/uncle has died before the deceased but has left children of their own, then those children will inherit that share of the estate instead.

- Illegitimate (born outside of marriage) children, and formally adopted children and other relatives can inherit, but not stepfamily.

- If there are no full siblings (born by the same parents) and only half siblings (born by one of the same parents) then the half-siblings will inherit instead. This also applies to aunts/uncles and cousins.

- If there is more than one person in a category, then they will receive the assets equally between them.

Who cannot inherit?

Because of the set order, some people close to you may not inherit if you die without a Will. These people can include:

- Unmarried partners, sometimes referred to as “common law” partners

- Stepchildren, and other people related by marriage

- Close friends

- Someone being financially supported by you, and not falling into one of the categories of people who can inherit

- Carers

What if there are no living relatives?

In some cases, there are no living relatives to inherit the estate. Once it has been established that searches have been made for any living relatives, the estate will pass to the Crown. This is known as passing ‘bona vacantia’. The Treasury Solicitor is responsible for holding these assets.

You can make a claim on these assets if you expected to have received something under the estate. For instance, perhaps you are a carer for the person who has died, or you were living together (but unmarried). If you wish to make a claim, you can contact the Government department dealing with bona vacantia estates by telephone on 0207 210 4700.

Who deals with administering the estate when there is no Will?

A person who deals with an estate when there is no Will, or where no executors in a Will are able to act, is known as an administrator.

When there is no Will, there is a strict order of who can deal with someone’s estate, similar to being someone’s next of kin. You can deal with the estate if you are the:

- Spouse or civil partner

- Child

- Grandchild

- Parent

- Brother or sister (if you are the child of a brother or sister of the deceased who died during the deceased’s lifetime, you and your siblings can apply instead)

- Grandparents

- Aunts/uncles (if you are the child of an aunt or uncle of the deceased who died during the deceased’s lifetime, you and your siblings can apply instead)

Half brothers and sisters, or half aunts and uncles can apply under a category only if there are no full relatives in that category still living.

Assets which cannot be inherited when there is no Will

The main types of asset which cannot be inherited under the rules of intestacy when there is no Will include:

- Jointly owned assets, if the co-owner has an automatic right to receive the deceased’s share upon the deceased’s death

- Pension funds

- Life insurance policies

To find out the way in which assets are jointly owned, you should check with a legal professional who will be able to confirm this to you.

Can you change the way the assets will be divided between the people who inherit?

If you are not happy with the division of assets, you and other beneficiaries can agree to change this. This is known as entering into a Deed of Variation. You can all prepare and sign a Deed of Variation to set out the new division of assets.

This is often done where someone left out of the intestacy rules wishes to inherit from the estate. The other people inheriting from the estate must agree to this change to the rules of intestacy.

You should ask a legal professional to prepare this document to ensure that it has been prepared correctly. Otherwise, the document may not be valid.

For more information on varying the intestacy rules, read our guide to variations.

What if a beneficiary cannot be found?

Sometimes, and particularly when dealing with distant relatives, it can be difficult to locate a beneficiary to let them know that they are due to receive a share of an estate, or even that they are entitled to deal with the estate administration when there is no Will.

For more information on what to do when you cannot find a beneficiary, read our guide to missing beneficiaries.